Real Estate's Four Great Challenges - Part 3

Jeff Koons installation in Station F, Paris

This is part 3 in a series of 5 posts looking at the four great challenges facing the real estate industry on the road to 2030.

Part 1 is here

Part 2 is here

———————————-

Challenge No 3 is:

What to do with a flood of obsolete buildings?

Challenge number 3 follows on from the previous 2 challenges. Both of which have an inexorable logic that points to a great deal of obsolete space coming down the track. Either because buildings are not, and cannot, meet sustainability targets (or at least have no economically viable path to getting there) or they are simply not suitable for playing host to the types of workplaces we are going to need in the future.

Cushman & Wakefield, in early 2023, issued two reports that are the most honest and realistic I have seen from a real estate professional services company. Both are entitled ‘Obsolescence equals opportunity’ and look at ‘The Next Evolution of Office and How Repositioning and Repurposing Will Shape the Future’ - one from a US perspective and the other from a European one.

As they say the aim is ‘to illuminate the degree to which existing office inventory fails to meet occupiers’ needs for engaging, efficient and sustainable office space. In doing so, we directly acknowledge the bifurcated existing demand-supply imbalance, while also evaluating how much office product could be rendered undesirable by the changing needs of a hybrid workforce.’

The commentary and numbers are striking:

‘the U.S. office sector is facing an unprecedented imbalance in supply and demand—one that will result in an excess of 330 million square feet (3 million square metres) of vacant space by the end of the decade brought on by the impacts of the hybrid work environment.’

This 330 million increases the ‘normal or natural’ level of vacancy by 55%. So hybrid is clearly going to have a big impact.

But they proceed to cite numbers that make your head spin:

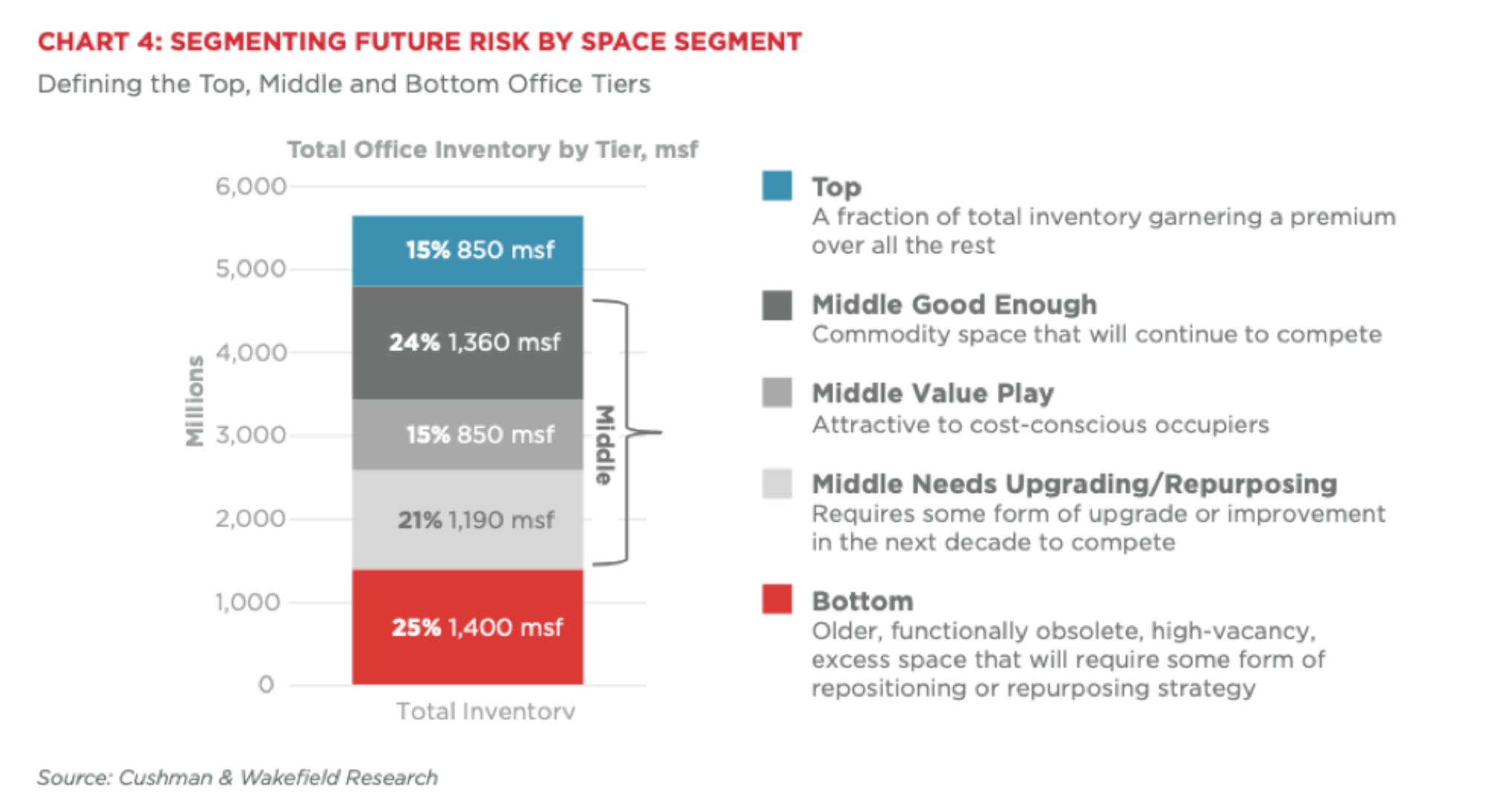

‘By 2030, only 15% of the 5.68 bsf (530 million square metres) of office product will classify within this highly desired category.’ Referring to what they call ‘Top’ buildings.

In reference to the ‘Bottom’ they write ‘Upwards of 25% of office stock throughout the country is growing increasingly undesirable and will need to be reimagined and made relevant for the future.’

And then in the ‘Middle’ they subdivide buildings as ‘Good Enough’ (24%), ‘Value Play’ (15%) and ‘Potentially Obsolete’ (21%).

So that’s 46% of the entire US office stock of 5.56 billion sq ft (530 million square metres) either already obsolete or potentially obsolete.

2.5 billion sq ft (230 million square metres) of obsolete space!

In the Europe report they don’t sub-divide the middle category and boldly state:

‘By the end of this decade, 76% of office stock across Europe will be at risk of obsolescence unless landlords actively invest in improving the quality of their space or look to find alternative uses for it, starting now.’

Now, there are two ways you can look at this. As good news or bad news.

But before we do let’s look briefly at 7 trends that are impacting the types of offices people want, the amount of space they need, and the locations they prefer.

As we discussed in Part 2, the pandemic has led to a massive and structural preference for more choice and flexibility in where people work. So per capita demand for office space is significantly decreasing.

In turn Space Optimisation will follow. In the short term we are seeing a lot of sub-leasing going on, or at least being attempted, but come a lease event it would seem highly likely that, per capita, companies will reduce their space requirements. Also quite likely is companies who have multiple locations consolidating these into one core space. Overall the mantra will be #LessButBetter.

Part of ‘Better’ is space that can effectively look after occupants ‘Health and Wellbeing’. The environmental quality a space offers is more important than it used to be, and likely to get ever more so.

Decentralisation is likely to occur. If employees won’t accept long commutes anymore, then moving offices to be nearer to them, in one form or another, is likely to follow.

Amenities and employee experience matter in a hybrid world. Rule Number 1 is that you must have a reason for people to come to the office. One part of that reason is very likely to include wellness-focused amenities, such as outdoor spaces, fitness centres, and dedicated relaxation areas. This is an increasingly sophisticated area, where pursuing an ‘amenity war’ alone is a dead end whereas designing and implementing an entire end to end ‘experience’ is the hard but correct strategy to adopt.

Top class technology, and integrated technology, is now essential. Remote working has emphasised its need. For an office to be in demand it has to provide reliable internet connectivity, advanced video conferencing facilities, and smart building technology.

And of course Sustainability. As we discussed earlier (Part 1) regulators are insisting on it, investors won’t fund or buy without it, and occupiers, especially the ‘best’ ones, won’t occupy anywhere not deeply sustainable.

All of the above is leading to the huge obsolescence numbers mentioned earlier.

What on earth are we going to do with it all?

Really we have four options:

Reposition: This involves upgrading the existing building to meet current tenant demands and market standards. This option is suitable for buildings with good structural integrity and a desirable location.

Repurpose: If the assets future as an office is no longer viable we need to repurpose it for a different use.

Refurbish: This is similar to repositioning in the sense of involving a lot of structural and systems improvements, but is more about enhancing design and character. This option is suitable for buildings with significant historical or architectural value that are worth preserving.

Or the last option is to demolish the building and start again. This will often be necessary but increasingly unpopular on the grounds of sustainability. You might replace the building with a net zero building but the embedded carbon you create in doing so might offset many decades worth of gains.

What are we likely to see a lot of, and which is likely to appeal to the more creative, innovative real estate people and companies?

I think we’ll see a lot of refurbishment of buildings of architectural merit, design and character. Given that we’ll be needing places of work that catalyse human skills, sacrificing some modernity in favour of beauty and inspiration isn’t a bad bet. Where would you like to work?

And I think repurposing will be huge. Where we give up on offices and do something better with them. This could take many formats.

Here are some:

Coworking or flexible workspaces: Repurpose buildings for coworking or flexible workspaces, catering to freelancers, startups, and project-based needs.

Educational facilities: Convert offices into schools, colleges, or training facilities, utilising existing layouts and infrastructure.

Healthcare facilities: Transform buildings into clinics or healthcare centres, requiring modifications for regulatory requirements and patient needs.

Community or cultural centre: Create community centres, cultural institutions, or non-profit headquarters, adapting large spaces for various purposes.

Data centre or technology hubs: Convert buildings into data centres or tech hubs, requiring significant infrastructure upgrades but offering long-term profitability.

Self-storage or warehouse: Repurpose buildings into self-storage or warehouses, making modifications for storage units, loading docks, and freight elevators.

Urban farming or vertical farming: Create urban or vertical farms, providing sustainable produce sources for local communities, but requiring specialised infrastructure.

Sports or recreational facilities: Transform buildings into sports or recreational centre, utilising large, open spaces from existing office layouts.

So there are options. Pretty much to cover all scenarios. The difficulty might be though that a cookie cutter approach isn’t going to work in this environment. Dealing with obsolescence is going to be a game for the creative.

Whatever you do though we’re going to need technology like never before. We are trying to create spaces that are very human-centric and that requires a lot of human skill. But human skill leveraged by technology is going to be vital. We are deep into high tech / high touch territory.

So what technology will be needed?

Digital Twins: for design & planning, construction & renovation, building performance optimisation, predictive maintenance, tenant engagement and experience, and streamlining facility management processes.

Internet of Things (IoT): Devices & sensors to monitor and optimise energy usage, lighting, HVAC, security, and other systems.

Energy efficiency and sustainability technologies: Green building tech, solar panels, green roofs, energy-efficient HVAC systems, and advanced insulation materials, focussed on reducing a building's environmental impact and contributing to long-term cost savings.

Virtual and augmented reality (VR/AR): Visualise and experience a space before it's built. Useful from design to construction to marketing, to sale or letting.

Artificial intelligence (AI) and machine learning: Everywhere and in everything!

Robotics and automation: Streamlining construction processes, improving safety, and reducing labour costs. Plus building maintenance, cleaning, and security.

PropTech platforms: Integrate, Integrate, Integrate is the new Location, Location, Location. Real estate is a system. We want 'Products', not features.

5G connectivity: What can be done with high-speed, low-latency connectivity? More than many think.

Cybersecurity: Who’s building has been hacked? Who’s quietly paid a ransom? Dull and boring - until it’s you.

So there is a lot going to happen. Millions upon millions of square feet or square metres of obsolete space is coming. We have options, and we have the technology. Or at least will have.

How should we look at this though? It’s definitely a challenge.

But is it Good News or is it Bad News?

This is the Bad News Perspective:

‘The high percentage of obsolete office stock poses financial challenges for landlords and investors, with declining rental income and property values. Redevelopment complexities, environmental impact, and tenant displacement add to the concerns in addressing obsolescence.’

Sounds right doesn’t it? Nothing in that paragraph is not true. It really would not be hard to look at the situation like this. Perhaps doing so is the rational thing to do.

But there is a Good News Perspective

What about if we looked through this lens:

‘The looming challenge of obsolescence paves the way for visionary developers and investors to seize the moment and redefine the urban landscape. Embracing the transformation, they can create vibrant, sustainable, and future-proof spaces that foster innovation, collaboration, and a sense of community. This metamorphosis will breathe new life into cities, making them more resilient, adaptive, and inspiring places to live, work, and play.’

Here’s to the visionaries: your time is now!