THE BLOG

Real Estate AC - After Coronavirus

A 20 minute talk I gave at the ‘PropTech, Data and Innovation Summit‘ in November 2020. But still as applicable today.

The Real Innovation Academy: A Year of Learning

David Hockney’s “The Arrival of Spring in Woldgate, East Yorkshire in 2011” - from his Four Seasons collection.

The four ‘essentials’ of #FutureProofRealEstate

Just over a year ago Dror Poleg and I launched Cohort No 1 of the #FutureProofOffice course we developed for our newly formed Real Innovation Academy. Though planned before Covid overtook all our lives, the pandemic gave added impetus, even urgency, to what we had in mind. We were already convinced that the real estate industry was undergoing profound disruption, but now it seemed this change was going to occur faster than even we imagined. Being #FutureProof was turning from being a nice to have to a necessity. The 10 year real estate boom, where innovation was hardly required, was turning to a bust where innovation would be everything.

Next week we will be launching Cohort No 7 of the Office course and Cohort No 2 of its sister course, #FutureProofHousing. To date we have over 350 Alumni, from 32 countries across 6 continents. No one, yet, from Antartica.

So, what have we learnt?

First off, the much trumpeted mantra that real estate is an industry of luddites, wedded to the analogue in a digital world, needs to be put to bed. Admittedly our audience is self selecting and perhaps not indicative of the wider market, but the level of imagination, innovation, forward thinking, positivity and smarts (street and academic) that we have encountered in our students has been an absolute pleasure to be exposed to. It’s not only the tech industry where people who want to ‘change the world’ work. You’d not be worrying about whether we really can ‘build back better’ if you’d sat in on the discussions at the Academy. Making an impact is the starting point. Nothing less.

We wanted to build a network of the smartest, most interesting people in real estate around the world, and we’re off to a good start.

The second thing we have learned though is something that has evolved over the year. The course is predicated on the idea that the nature of demand for real estate is fundamentally changing, and that supply will, indeed has to, change in response. What has become clearer though, from running both courses and the dozens of hours discussing, presenting and analysing the industry, is that how we need to respond to this change, across all asset classes, boils down to just four themes. And working upwards from these four foundational pillars is the route to creating products and services that are fit for purpose, and #FutureProof.

Theme number 1 is customer centricity.

Steve Job provides the canonical example of this. Shortly after returning to Apple, at their Developers Conference, he was aggressively asked during a Q&A session why developers should have faith in him, as he seemed to not know that much about technology. After a pregnant pause, where he was clearly angry with the questioner, he said ‘You’ve got to start with the customer experience and work backwards to the technology…I’ve made this mistake probably more than anybody else in this room…As we have tried to come up with a strategy and a vision for Apple, it started with ‘What incredible benefits can we give to the customer? Where can we take the customer?’...I think that’s the right path to take.’

Start with the customer and work backwards to the technology.

Substitute real estate for technology, and then back from real estate to user experience, and you have the best starting point for any business plan.

Jeff Bezos designed the ‘working backwards’ process at Amazon based on this principle. What benefits the customer? So long as you have a laser focus on pleasing your customer, you have the makings of a great business. Don’t focus on what you want, focus on what your customer wants.

This is not the natural order of things in real estate. Because it never needed to be. People needed shops to go shopping and they needed offices in which to work. Over the last 15 years or so the retail real estate industry has learnt this is no longer true, and over the last 15 months the office real estate industry has been learning the same lesson. In retail and office, our customer no longer needs what we have to sell. We need to make them want what we have to sell.

All around us are examples of retail real estate companies, and retailers, who have not cottoned on to this new absolute truth. Many owners and occupiers of offices are going to follow suit over the next 24 months.

Before doing anything, we in real estate need to get to grips with how are we going to better understand the wants, needs and desires of our existing or prospective customers? Across all asset classes.

Theme Number 2 is creating tech enabled ‘Smart’ assets.

We are no longer simply the providers of dumb shells, we are the providers of hardware, software and services that needs to work together to offer our customers the spaces that provide them with the services they need for their ‘jobs to be done’.

That is what a ‘Smart’ asset is. Somewhere that understands what its purpose is. What benefit it is there to offer the customer.

This is why so many smart assets are not that smart. Anyone can kit out a building with tools, technologies and the latest gizmos. And many do. But far fewer kit our their building with only the tools, technologies and gizmos that are needed to provide the UX, the user experience, that they have deliberatively designed for the particular type of customer they are wishing to serve.

Start with the customer and work backwards to the technology.

Real estate is a siloed industry. Just taking offices, there are six industries that need to work together to create a great workplace. Real estate, IoT Networking, Data analytics, Workplace, HR and Hospitality. And they rarely talk to each other. They almost certainly do not all talk to each other before a project starts. So the creation of a truly ‘Smart’ building has little chance of success built in from inception.

Smart assets absolutely need the right technological infrastructure, but this is necessary but not sufficient. A smart building needs to be human smart as well as tech smart.

Smart is a quantitative and qualitative game. Across every asset class. The tech is there to ‘enable’ something. Work out what you want to ‘enable’ first.

Theme No 3 is about storytelling.

Why is someone going to buy, lease or rent your real estate? Do they have to? If the answer is yes then you can skip this section.

Historically the above question would have led to 95% of people skipping this section. Because historically our customers, in most situations, had to buy, lease or rent our real estate. It’s why real estate has made so many people so wealthy over the centuries.

But today, as we discussed above, our customers most likely do not need to do business with us. They have optionality, as the economists say. They can satisfy their needs in other ways.

Hence we need to become story tellers.

Great Brands represent great stories. They have meaning to their customers. Their ‘story’ evokes pleasure, pride, greed, avarice. The Hermes ‘Birkin’ handbag is an an example of what is known as a Veblen good; something that gets more desirable the more the price is raised. Primark, the retailer, work at the other end of the scale, where their clothes become more desirable the cheaper they get. Disposable fashion to eternal fashion. Both tell great stories.

Most analogous for real estate, I think, are the premium car Brands. The most important customer for Audi, BMW or Mercedes is the person buying their first premium car. Because, like the Jesuits, once they’ve got you you’re likely to stay. People buy into brands like this. They buy into a certain style, a certain user experience, and certain ethos. And they invest more than money into them. They start to become, to an extent, defined by them. I am this ‘type’ of person.

In real estate we are going to see the development of Brands, across all asset types, as powerful as these. In offices, the operator of the space is going to become as important as the operator of a hotel, and companies and individuals will become loyal to particular brands. Because particular brands stand for particular user experiences, different ‘end to end’ stories, and over time will know how I want my space set up. It will be hard to wean a customer off a competitor who knows them much much better than you do. It’ll be like trying to get an iPhone user to switch to Android, or vice versa. The switching cost will just be too high.

The same applies for residential, retail, industrial … all asset classes. Remember, we are no longer just selling hardware (dumb boxes) - we are adding digital layers of software and services on top of this hardware. We are, via our human and technological skills, building stories around our buildings.

Modern economies are increasingly valued based on their intangible assets. Our Brand, our story, our user experience, these are our intangible assets.

Ultimately UX will equal Brand, and Brand will equal Value.

Theme 4, the final theme, is about relationships.

The real estate industry has always prided itself on being a relationship business. But usually those relationships were with other people in real estate. So the industry talking to itself.

#FutureProofRealEstate will still be an industry built on relationships, but built on relationships with customers. Nothing will be as important as owning the relationship with our customers.

But who are our customers you might ask? Well, they are not who they used to be. In the past the most important customer, indeed probably the only person treated as a customer, was whoever signed our leases or quarterly rental payments. No-one mattered much besides them. That was the beauty of real estate. Long leases with upwards only rent reviews were a wondrous invention. But those days are dead, or dying. Today, in a world where our customers no longer need us like they used to, we have to please everyone who uses our spaces and places. For long term success, we need to give everybody a great user experience. The customer of real estate in the future will be the user of real estate. All of them.

This can either be, as they say in tech, a bug or a feature. It’s a bug if you do not have that relationship with these customers, because there is then little you can do to influence how much they enjoy your assets. You’ll be commoditised, and nothing more than the owner of the ‘dumb box’. Your fortunes will be dependant on the quality of the middleman, the operator, you have outsourced your customers relationships to.

But if you own the relationship, and do everything we have discussed above to make the user experience of your asset as exceptional as it can be, you’ll be in a position of real power. Having invested so much into understanding the wants, needs and desires, of your customers, and then by real time monitoring and optimising of these variables, you’ll be able to leverage this relationship in meaningful, beneficial and profitable ways, for your self and your customer.

People spend 90% of their time indoors and in real estate we connect with people for longer than any other service provider. So it is us, in real estate, who are in the best position to service the needs of our customers. We can move way beyond just letting them space by the foot or metre: we can help them be happy, healthy and productive. We can enhance their pleasure whilst shopping, or make them more comfortable when at home. We can do much more than we ever have before. But only if we own the relationship.

And that is it. The four themes above are applicable across every real estate asset class:

Focussing on the customer and understanding their wants, needs and desires

Creating efficient tech enabled smart assets

Developing ‘end to end’ stories and building Brands around them

Owning and leveraging the customer relationship

They form the foundations of the next generation real estate company. Sure, each asset class requires particular skills but, unlike in ‘old’ real estate, the core is the same now we are moving beyond selling a product to delivering a service.

Real estate is now a ‘Space as a Service’ industry, providing our customers with the spaces and services they need to do whatever it is they wish to do, wherever they are.

We cannot wait to continue the iteration of #FutureProofRealEstate with our next cohorts, starting June the 24th.

Come join us - register at realinnovationacademy.com

Antony

This isn’t an acceleration, it’s a revolution

An Experiment on a Bird in an Air Pump by Joseph Wright of Derby, 1768

The office real estate industry is set to be transformed.

In the world of work and the workplace there is a fundamental misunderstanding going on. Many people are talking about changes to how we work, post pandemic, as being merely an acceleration of trends that were already underway. They are not. In fact, we are witnessing the start of a revolution that will utterly transform the dynamics of the industry.

Pre pandemic it is true that many companies had adopted a smattering of remote working and working from home. In a city like London it was common for many employees to only be in the office 4 days a week. And then the pandemic hit, and we all (with caveats of course) moved to five days a week working from home. A year later the common refrain is that when we return to the office we will adopt some form of hybrid working, where some are in the office and some not. A smorgasbord of working patterns will emerge.

And this is where the misunderstanding will rise up and cause chaos. Because we are thinking this is an acceleration, we think it's just an iteration of the way we worked, and companies operated, up to March 2020. Everything stays the same but we throw in a bit more flexibility and remote working. After all, haven’t we all been working like this for a year or more?

No is the answer. Today we are all working remotely, so the expectation is that everyone is easily contactable because they are at home. But when we return, and go hybrid, we will not know where anyone is. They might be at the office, or they might be at home, or in a coffee shop, a local flex space, a hotel, or a clients office, or wherever. And here the chaos begins. We could function easily remotely because all being at home was like all being in the office. We’d just reconfigured life as it was, as a fundamentally office centric company. Nothing really had changed. Hence the idea of an acceleration, just a bit more of what we were doing anyway.

But this is no acceleration. It’s a revolution. We are going to be moving from being office centric companies to WFA (work from anywhere) companies. And that cannot happen without major, disruptive, change.

Just look at the headlines about Zoom fatigue, back to back video calls, the merging of home and the office (‘I live at the office’ etc), an inability to turn off, to separate home and work life. These are all the consequence of the ‘acceleration’ misunderstanding. They are what happens when an office centric corporate way of live moves, en masse, out of the office. We are working to the same patterns, but somewhere these patterns should not be. It’s bearable when we are all in it together. It will cause chaos when we are not.

The revolution coming will be the result of having to change how we operate, as individuals, and as companies, when we move to hybrid working. When should we be in the office, when somewhere else, and where somewhere else? Who’s going to bring in and bring on new employees, who’s going to mentor them? Most of the senior management team are more than comfortable working mostly from home, whereas those in their earlier working lives want to be ‘in town’, not least because they are going out after work. Is the office just somewhere for the young? What about culture? That used to be understood through the acquiring of tacit knowledge, from just being around and seeing how things work. But people aren’t around so much now, and work is being done out of sight.

In every aspect of company life, being structured as an office centric company whilst not being in the office, is going to give us the worst of all possible worlds. No serendipitous meetings, no water cooler meetings, no overhearing that nugget of information, no learning from observing. During the pandemic it was fine. We knew where people were and we could get hold of them immediately. Even if that meant endless Zoom meetings, longer days, no separation of life and work, that’s what we did. Because in the office we could do this. See anyone straight away, tap them on the shoulder, disturb their flow, talk too loudly and ruin their concentration. Yes, everything we did was synchronous. I want to know this now. I want, I want, I want….. now.

It’s just not going to work is it? If we go hybrid post pandemic we need to rethink everything about how our companies work and operate. We need workflows that suit the way we work. And those office centric ones simply won’t cut it anymore. And, as we will see, our real estate won’t cut it anymore either. We are about to blow up the real estate industry. Without realising it.

Where to start? As Steve Jobs famously said ‘you have to start with the customer’. Within our companies, to understand what we need from our offices, those customers are our employees. Without knowing and understanding their needs your future office plans will be dead on arrival.

For every employee you need to first understand what it is they do, what are their ‘Jobs to be done’. Their job will be made up of various tasks, and each task will have an ideal working environment. Each task will also have other dependencies, such as the need for particular software, hardware or services. And, of course, each task will either be able to be carried out alone, or will require the presence of other people. Map these out for all your employees.

From data can flow action. With all this information you will be able to answer those questions about who needs to be where, and when. And what data they need access to, from where they can get it, and where does it need to go after they are finished with it. And from all of this it will become clear what systems you need, and what ‘jobs to be done’ need to be done synchronously or asynchronously.

This is how to think as a hybrid, non office centric company. Get this data analysed well and it will inform so much about how you need to operate. Not least of all it will transform how you think about your office needs. Almost certainly this will involve a realisation that you need less but better space (for which you will probably have to pay more), most likely in diverse locations and procured on different terms.

I would wager it would convince you that henceforth you should be thinking about ‘Space as a Service’, where you purchase what you need, when you need it. And that might be five days a week, or it might be 1 day a week. What you consume needs to reflect what the needs of your ‘customers’ are, your employees. Your aim is not to have to think about real estate, your job is to enable your employees to be as happy, healthy AND productive as they can be. You want to be people centric, not office centric.

When the above occurs, as it will, the current business model of the real estate industry falls apart.

The way it works today, and has done for decades, is that the customer of a developer of office space is not the occupier, but the investment community. Buildings get funded (largely) by long term investors, like Pension funds. They want income streams that are secure, steady and reliable. They don’t want risk, and they certainly don’t want any out of the box innovation or new thinking. They want to buy a Bond. And for decades that is what the industry has delivered. Buildings where large sums of money can be parked, secure in the knowledge of quarterly rents being paid.

See the problem? Given what we’ve discussed about what companies (occupiers) need in the future, these two requirements are about to clash. One wants steady inflexibility, the other dynamic flexibility. One side is not going to get what they want.

Hence the coming revolution. Because there is a confounding variable which tilts the balance strongly in one direction, that of the occupier. And that, of course, is that over the last year, with probably another 3-6 months more to go, almost every knowledge company (aka office centric company) has realised that they can, should they need to, run their businesses away from their offices. To many it has come as a huge surprise that that office they felt was an essential need, is actually not as needed as they thought. It is very likely that they still want an office, but want is a different driver to need. Things you want but don’t need demand different terms.

And flexibility is what the non office centric company needs. It is well known that flexibility always comes at a price but when it comes to real estate, for a company, flexibility probably trumps price.

So what happens now? Is the elephant in the room being addressed? I think not. The investment community is wedded to a business model that suits an increasingly diminishing section of the market. The real estate leasing industry is still, mostly, talking of occupier needs for workspace that don’t tally with reality. Or at least the post pandemic reality that is lurking unseen.

There is a square that needs to be circled. Structurally the industry is not shaped to provide what the customer wants anymore. As long as we pretend that what is happening in the market is just an acceleration of existing trends we can sleep tight and ignore the brick wall we are careering towards. But if we open our eyes and understand that the days of office centric companies are over, we can start planning for the revolution underway.

People are not, by and large, going to go back to being inmates of white collar factories. They want something better. They need something better. And, given time, they will get something better. But it’s not going to just happen.

Something always sparks a revolution. That spark will light when we ‘return to the office’. And discover, it’s no longer fit for purpose.

CBRE & Industrious - The Chicken and the Pig

Head and wings of a fantastic bird. 1507-19 Albrecht Durer

On the 22nd of February it was announced that CBRE had bought a 35% stake in Flex space provider Industrious for circa US$200 million in cash.

In addition to the cash CBRE will be transferring their own 10 location flex brand Hana to Industrious.

What does this tell us?

It tells us that CBRE is a chicken, and Industrious is a pig.

I have a lengthy presentation about #SpaceAsAService, and in this 8 factors critical to success are defined. No 1, in the prime spot, is a slide that asks ‘Are you a Chicken or a Pig?’. This riffs on the joke about ‘What is the difference between a chicken and a pig in a bacon and egg sandwich? To which the answer is ‘one is involved, but the other is committed’.

The reason it is in the No 1 slot is because whilst it does not matter which you are, if you are going to be an operator of flex space you have to be a pig. Operating flex space is too complicated, and too much a mission, for it not to be central to your core business.

For a giant brokerage like CBRE Hana was never going to be core. Yes they had the clout to throw a lot of money at it, but without it being something they invested real, from the core, commitment to, was it ever going to succeed? Their core, transactional business would definitely benefit from having ‘skin in the game’ of the flex market, enough so that they deeply understood the dynamics of the sector, but strategically the much better option, by far, is to do so via a true ‘pig’ company like Industrious.

Where this leaves other real estate services companies is interesting. Has the Hana experience 100% invalidated any of them them trying to launch their own flex operations? Probably. So what should they do?

Last year I criticised another real estate services company partnering with an operator, on the basis that they should be buying at least a decent sized stake instead. If they executed their partnership well buying a stake would become almost an inevitability, but by then it would be much more expensive. The ownership stake itself would provide the incentive to execute well. Put some ‘skin in the game’. And save yourself a fortune.

The CBRE situation has, I think, validated this argument perfectly. The pandemic may have done this particular company a favour, in postponing their partners growth trajectory, but if I was them I’d be coughing up for that meaningful stake asap.

Where this gets interesting is in thinking about the position of landlords. Covid is clearly a near term ‘bug’ for the flex industry, but it is a massive long term feature, as the demand for flexible space is set to grow enormously. To the size that every landlord, even every prime multi let office building, will need to offer flex options.

To date some landlords have been building their own offerings. But are these efforts even nearly enough? Are we dealing with chickens or pigs. I think most definitely the former, as with CBRE. The ‘skin in the game’ is trifling, even for pre pandemic conditions. For post pandemic demand orders of magnitude off.

So. What to do now? Current plans are too little. Is internal commitment lacking as well? The flex sector is becoming core, or at least a critical component of any serious, scale landlord. So ‘Pig’ behaviour is needed. Are they up for that? CBRE said they were with Hana. But they weren’t. Perhaps, given the way the real estate industry is structured, that was, and will be, an inevitability.

It’s make your mind up time. Landlords that are building out their own flex operations need to up their commitment 10X, or they need to make plans to back out immediately, and work on Plan B. Which is to decide who their target customers for flex space are, then pick a range of truly committed partner operators (because different customers types require different brands and value propositions). Then they need to align the incentives between themselves and these operators. By buying meaningful stakes!

The Redundancy of Real Estate - and how to avoid it.

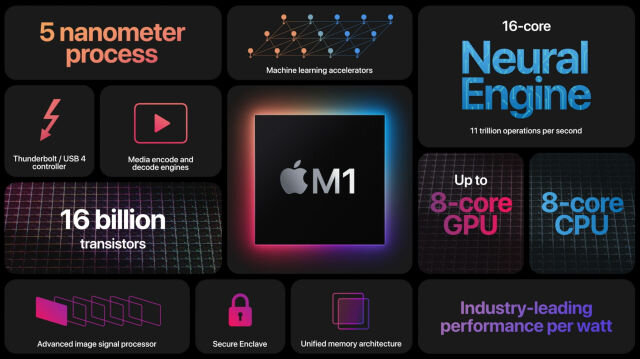

On November the 10th, Apple unveiled its new M1 System on a Chip. A processor so fast, and so abstemious in its power consumption, that it has in effect blown up the laptop PC industry. The new $999 MacBook Air is as fast as a $6000 MacBook Pro of 3 years ago. And this is the entry level processor. Over the next two years larger, more powerful versions will be developed to power the entire Apple range of computers.

And with this the Intel based era of computing will come to an end. For sure, Intel will still be a huge company for years to come, but its dominance has been eradicated, just like that. As John Gruber the technology commentator has written ‘The M1 Macs are such better machines than their Intel-based predecessors it’s hard to believe.’

During the same month we have seen the announcement of not one, but three, new vaccines to counter Covid-19. Each developed in less than a year, a feat of extraordinary brilliance, as the norm for developing vaccines is measured in decades not years.

And these ground breaking technological developments have taken place during a global pandemic where almost every knowledge worker is working from home. And where the process of development has spanned many countries, and continents. Extraordinary feats of intellect, #NoOfficeRequired.

Which tells us what?

Well, according to many in real estate, not a lot. Repeatedly I come across comments online about how ‘offices are needed for creative work’ or ‘relationships need physical proximity to build’ or ‘you cannot innovate sitting on the sofa’ or ‘we’re all surviving on relationships we had pre Covid’.

Some go even further. Stephen Bird, CEO of Aberdeen Standard Life was recently quoted as saying “You cannot change the world from home, It’s an absolute falsehood. It’s lazy thinking, it lacks courage and it’s delinquent on the next generation.”. Not someone from real estate admittedly but I get the feeling many in our industry would agree with him.

It’s hard to know where to start in explaining just how dangerous and deluded such thinking is, but I think it all stems from a lack of awareness of technological progress combined with poor personal digital skills. People are talking about things they know little about. Taking advice on driving from someone who doesn’t drive makes no sense. And we shouldn’t do it.

Working in a distributed company is not the same as working in an office centric one. It’s never the case, long term, that you can move to being a distributed company by simply moving people out of the office, but maintain the same policies and practises as you had before.

Starting in March this is what most of us did, and by and large, it has been a remarkable success. Every credible survey of remote working (under pandemic conditions) has shown that for the majority of people, perhaps 70-75%, it has worked, and worked well. For the balance it very much has not. And it has become clear what it is we miss, and don’t miss, from our old, more office based lives. For more on this please visit leesmanindex.com, where they have a wealth of detailed analysis.

We are now though at a crunch point. We’ve been working, by decree, remotely for eight months or so. Long enough to realise that the old ways of working, based on 4/5 days a week of physical proximity to our co-workers, are perhaps not the best way to operate, when apart from each other. Hence complaints about too many Zoom meetings, long hours, burn out and lack of connection. Adrenaline got us through the first few months, but now we need something different.

It’s not working remotely that is the problem, it’s not knowing how to work remotely. And the biggest problem of all is when management doesn’t know either. That’s when we start getting comments about ‘you cannot do XYZ at home’. Better stated they would be saying “I cannot do XYZ at home”, because that is the real issue. When managers do not know how to manage remote teams, problems start to arise.

We need some training.

Take a look at the tech companies. Twitter have told their employees there is no need to come back to the office, Google & Facebook have said don’t bother till mid 2021. Gitlab & Automattic both employ over 1200 people, across 60+ countries, but neither have any offices. Box say work anywhere till 2021, and then we’re going hybrid. Dropbox is going ‘Virtual First’, as is Shopify. And on it goes.

Each of these companies are amongst the fastest growing, most valuable companies in the world. With many of the highest paid employees. And they’ve moved to being distributed with hardly any issues. Why? Because these are digital first companies, where technology is used throughout every process, workflow and project. Where data is in the Cloud and everyone is equipped with quality hardware, software and services that enable pervasive communication and collaboration. Where work has mostly gone asynchronous, and interaction is mainly through a wide range of online SaaS (Software as a Service) tools such as Slack, Trello, Asana, Jira, Workday, Notion, Miro and Mural. In short, where all the things many real estate people say are only possible in the office, happen outside an office.

We need to learn from this. We need to adopt some of these tools, become familiar with how truly digital companies work, and how they think, and how they communicate, and mentor, and learn, and innovate. Because these types of companies (and they will increasingly not be confined to tech companies) can be super efficient and blindingly effective. If your company comes up against such an organisation you better be prepared for some serious competition, because as digital native companies they will be, ceteris paribus, hard to beat.

None of which is an argument for ‘the office is dead’. Tech companies are different to non tech companies but even they will still be taking a lot of space. Less than they probably would have pre-Covid but still plenty of it. And offices are still the best places for certain activities. And most companies will take office space, subject to it being designed and managed in a manner that actually delivers value.

But as an industry we must stop kidding ourselves that our customers need an office, that without an office they will not be able to innovate, or collaborate, or share knowledge, or grow. All of these things are possible with #NoOffice. Our job is to demonstrate why they should WANT an office. Why having an office enables them to do some things better than they could without an office. And more particularly why this office is better than that office. Without real differentiation we are just commoditised box builders. When your customers no longer need your product your Brand, what you stand for, becomes the most important asset you have. As I have said before, real estate is no longer about satisfying needs, it is about creating desire.

So lets get moving on up-skilling our industry. Let’s stop talking like analogue dinosaurs. No more ‘you can’t do XYZ online’. You can do everything online. Let’s learn the tools our digital customers use. Let’s grasp that real estate comes in many forms, and that ‘the office’ is going to mean something different in the future. Wherever our customers want to work, we need to be there. We need to give them what they want, not what we have to sell. We need to think like they do, act like they do, and innovate like they do.

If we want to attract the best customers, there really is no alternative.